Industry leaders see the new government’s proposals with hope

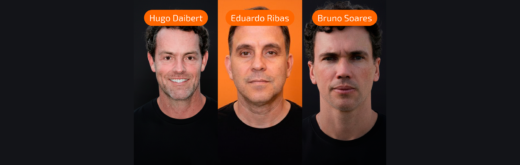

The election of a new government always arouses many expectations of change and brings the possibility of learning from mistakes and working on successes. In spite of the unfavorable economic scenario, according to Mauro Cesar Batista (photo), president of Sindseg-SP, the insurance sector registered growth of 5% to 10% between personal and property insurance. This makes the market outlook as positive as possible for next year.

The president of the entity takes stock of the year 2018: “It was a year of many challenges for the Brazilian Insurance industry; and why not say it to the insurance industry as a whole. The economic and political crisis that affected Brazil, had serious unfolding in all sectors of the economy and insurance was not left out. It was difficult to see many families depriving themselves of their health plans, because with almost 12 million unemployed, many have failed to honor their commitments, “he says.”Yet the insurance industry has grown from 5% to 10% between personal and property insurance, which leaves clear signs that there may be good prospects for 2019”.

Mauro Batista believes that 2019 will be a year of economic recovery and believes that the change that is so expected to occur in the country requires the effort and collaboration of the whole society. “The main scenario will be orchestrated by a new government that has a disciplinary discourse; but from discourse to reality, there is much to recover and build. Society must also do its part. It is not only by ending corruption that Brazil will find its way up. We need to have correct and ethical attitudes. There are signs that we can change for the better, but we must want and make it happen,” he says categorically.

Conscious of the importance of the entity in the current context, Mauro Batista also emphasizes that the Industry Union remains firm with the mission of being the regional institutional representation of the insurance system allied to the interests of society. “The union’s job is to defend the interests of insurers, which must necessarily coincide with the interests of society and the state. Just as we did in 2018, we want to demonstrate the positivity of insurance, as an agent of good that it is. Becoming indispensable every day to human life, “he says.

In relation to the partnerships with the State Government, he affirms that the intention is to continue, as was already done with the previous government. “We want to continue the construction of public policies of interest to all. We are undoubtedly living the digital age and for this we want to work to ensure that insurance is covered in all projects,” he concludes.

With positive balance in 2018, Seguros SURA bets on expansion

Thomas Batt (photo), Seguros SURA CEO’s in Brazil makes a positive 2018 balance and reveals that the insurer recorded growth of around 15% in all business fronts. The executive emphasizes that the focus on development and innovation in people and processes has also brought positive results internally. “We consolidated a concept focused on aggregating and connecting people, and so we created a collaborative environment with opportunity for all, based always on human behavior to generate value and positive attitudes. Today we have a team highly qualified to do business, with empowerment to support and contribute in the company’s daily life, with space for production and creativity, with pace and integration of all areas, “he says.

The Executive highlights the “SURA Confraria” as an example of a good practice carried out in 2018 and will continue to be strong in 2019. The program aims to recognize its main business partners. Created on the basis of pillars such as training, recognition and services, it brought several actions that benefited its partners. “In 2019 the company bets on team development, organizational culture, infrastructure and partnerships. The expectation is to maintain or exceed the level of growth of 2018 in all lines of operation”, comments. The insurer will also expand geographically in 2019, and will be present in new regions of Brazil.

You may be interested

Seguros Unimed é a nova patrocinadora da equipe Itambé Minas

Publicação - 9 de janeiro de 2026A equipe Itambé Minas vai contar com o patrocínio da Seguros Unimed, braço segurador e financeiro do Sistema Unimed, até o fim da temporada 2025/26. A seguradora, especialista em soluções que…

Gallagher destaca papel da especialização técnica

Publicação - 9 de janeiro de 2026Após quase um mês da sanção da Nova Lei de Seguros (Lei nº 15.040/2024), a Gallagher Seguros ressalta que o sucesso da implementação das novas regras dependerá…

Amil Me Leva 2025 foi uma das vencedoras do Prêmio Caio

Publicação - 9 de janeiro de 2026A viagem de incentivo Amil Me Leva 2025 foi uma das vencedoras do Prêmio Caio, considerado o “Oscar dos Eventos” no Brasil, no mês de dezembro. O…

Mais desta categoria