Event brought together brokers from four states and the Federal District and celebrated the fight against a dangerous enemy

By: Carlos Pacheco

De Uberlândia

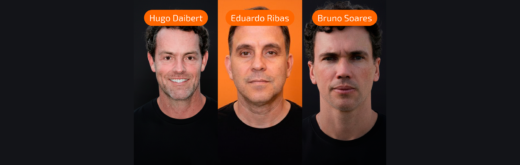

The threat of vehicle protection associations that want a significant part of the insurance market, treated as clandestine outsiders, polarized most of the debates during the 1st Central-West Regional Congress and Mines of Insurance Brokers (Congrecor) on 2 and 3 May, of the Center Convention of Uberlândia (MG). About 1,200 people, mainly professionals from different parts of the country, honored the event. Presidents of Sincors de Goiás, Mato Grosso, Federal District, Mato Grosso do Sul, Minas Gerais and other states, executives and presidents of the main Brazilian insurers participated in the panels and welcomed the brokers in their stands.

At the opening, Sincor-MG’s president, Maria Filomena Branquinho, highlighted the important brokers role, the main distribution channel in the country, responsible for the expansion of a sector was not affected by the economic crisis. Branquinho preached the union of the category, through the unions of all country that guaranteed important achievements. One of them, cited by the president of the National Federation of Insurance Brokers (Fenacor), Armando Vergilio, was the inclusion of professionals in Simples Nacional.

After, the president of the National Confederation of Insurers (CNseg), Márcio Coriolano, emphasize the power of the institutional strength of the market, the sector’s No. 1 enemy was quoted by congressman and president of Sincor-GO, Lucas Vergilio. “We, insurance brokers, are alone in this fight against vehicular protection associations. Minas Gerais was one of the first states to suffer marginal market action. It is necessary that the insurers and their representative entities discuss this problem with us “, shouted the parliamentarian.

The president of Fenacor added: “We need to unite in order to overcome a common enemy, the marginal market, which began with vehicular protection and is already contaminating other segments, such as heritage and life. It takes commitment and determination in this crusade against these associations, “he warned. The congressman is the author of the Complementary Law Project (PLP) 519/2018, which aims to regulate the performance of vehicle protection associations.

At the end of the opening of the 1st Congrecor, Globo News journalist, João Borges, analyzed the four months of Jair Bolsonaro’s government. In the speech, Borges presented a retrospective of the facts that were highlighted in the new government and then commented on the main perspectives of the economic scenario. “With GDP forecast to be only 1.1% in 2018, Brazil will be below countries like Argentina, Mexico and Uruguay,” he lamented. For the journalist, combating the fiscal deficit and the tax and welfare reforms are fundamental for the economy to grow again.

Marginal cooperatives

The crusade against the marginal market and the challenges of the broker in the current scenario were latent in the talk show “News of the Insurance Market”, highlight of the second day of the congress. Mediated by Lucas Vergilio, the panel brought together presidents Armando Vergilio (Fenacor), Robert Bittar (National Insurance School) and Márcio Coriolano (CNseg).

First to speak, Bittar revealed that today there are 90 thousand brokers in Brazil enabled by Susep thanks to the role of the School, whose participation always important in the development of the sector. According to him, since 2005, when the institution obtained authorization to teach a course of administration with an emphasis on insurance, there has been a gradual growth, both in the offer of courses and in investments. “The National School of Insurance has once again received the highest mark (5) in all matters by the Ministry of Education,” said Bittar.

Coriolano, on the other hand, considered that Brazil has a huge challenge of incorporating the population into the consumer market. In his thesis, there is an “opportunity environment” that the market must take advantage of to promote greater inclusion of people in mechanisms of social protection. The leader pointed a great challenge in the country: that of improving income distribution indices. In its calculations, 85% of the population earns up to 5 minimum wages, that is, with limited consumption power.

Lucas questioned the CNseg about its involvement in the fight against marginal cooperatives, considering that there is “institutional absence” of the entity in this fight. “We are with other industry players in advocating for a legalized and regulated market. At the Congress, insurers supported Bill 3139 and also PLP 519. We filed dozens of public civil suits with Susep against those who act irregularly, “said the president of CNseg. The deputy called on brokers to act against the associations because , according to him, the equity of the population with lower purchasing power is at serious risk.

In this worrying scenario, Armando Vergilio recalled that the broker should initially be aware of its advisory role, identifying hedges and benefits of insurance. Then, he assumes the position of client advisor, accompanying him permanently. “We have to stop with this story that the profession is threatened. However, if the professional does not modernize, it will be stagnant or lose market, “he warned. About the associations, it was exhaustive: “We hope to have the union of the whole category in this crusade against the marginal market, which does not pay taxes nor obey the same regulations as we.”

Changes in the market and consumption

Executives of the largest Brazilian insurers were protagonists of the panel “Innovation and Challenges in the Insurance Market”. The impact of technological tools, the consequences of changes in consumer behavior and the role of the broker in these scenarios were some of the topics addressed, at the invitation of the moderator of the debate, Maria Filomena Branquinho, president of Sincor-MG.

In the view of HDI president Murilo Riedel, the main challenge of the segment is to promote the adequate delivery of the products. Riedel suggests that insurers offer alternative insurance with guarantees. He mentioned, for example, the protection of low-value vehicles, “a good opportunity for the broker.” Anyway, the president of HDI has no doubts about the role of the professional as the main channel of distribution of the companies.

For Gabriel Portela, president of Sul América Seguros, “there are no insurers without the broker.” According to Portela, it is necessary to use technology as a tool to the broker to sell more. He added: “We are together in the fight against the marginal market.” The executive defends equality of conditions in the operation of the businesses in strict compliance with the law.

“The distribution of our products is 100% made through the insurance broker,” said the president of Tokio Marine, José Adalberto Ferrara. The executive reinforced the insurer’s concern about technology, investing $ 100 million each year, and training professionals for their digital inclusion. “Direct selling has never been in our plans,” he said.

Fernando Grossi, executive director of Sompo Seguros, emphasized the company’s central objective of seeking the development of new products, with a focus on retailing. Sompo is revamping its portfolio and launching new products in the market. As for the fight against the marginal market, Grossi thinks this is a “very big challenge”. He added: “Together we are stronger than these associations.”

The executive director of production of Porto Seguro, Rivaldo Leite, acknowledged that the car was responsible for the company’s livelihood for many years. “But now, it can not be the only way to support the broker,” he warns. With the diversification of the market in recent times, Rivaldo sees an attractive horizon for the consumer to work and continue being a professional indispensable to the sector.

Marcos Machini, Liberty Seguros’s commercial vice president, highlighted megatrends in terms of innovation – globalization, connectivity, experience economy, sharing and immediacy – allied to speed (cost of production on the internet). The company’s policy, according to Machini, is to invest profit in innovation, including the development of laboratory dedicated to the elaboration of products. To the broker, he suggests: “Make the offer first before the customer looks for it.”

“The technology changes the world quickly and we need to be attentive to that,” emphasized Mapfre Seguros Channel Director Comercial, Hamilton Torres. The executive warned an indisputable fact: the way of getting around is no longer the same. “In São Paulo and other capitals, scooters are competing with the automobile, while people make supermarket purchases through the application,” he said. Anyway, Torres believes that the broker can not lose its “essence”, that is, to sell using the technology in its favor.

Finally, in the analysis of the commercial director of Bradesco Seguros, Leonardo Pereira de Freitas, the market is changing in terms of risk and consumer behavior, which seeks new experiences. “Our industry was the only one that grew up in the double digits, even at the height of the economic crisis. In 2018, we returned R $ 2 billion to the company in the form of equity redemption, “he stressed.

The 1st Congrecor was complemented with the talk of the consultant Silvio Eduardo Andrade under the theme “The Speed of Transformation and the Paths to Innovate”. “You have to take the time to think about the future, the new, the tomorrow, and not just solving yesterday’s problems or what we have to do today. I advise the broker to try out the digital relationship with his client.” (Duilly Cicarini, Velo Seguros, Boris Ber, Asteca Seguros and Rogério Araújo, from TGL Consultoria) presented cases of success. “The results in terms of the participation of this 1st Congress assured us that we are on the right track, “was encouraged host Maria Filomena Branquinho.

Reflections punctuate opportunities and threats

Executive director of the Pasi Group, Fabiana Resende believes that the 1st Congrecor has met expectations in terms of quality and public, by bringing together brokers from various regions of Brazil. “Many professionals visited us, interested in our business model,” he said. Fabiana believes in the change of the economic scenario, from now on, with the labor reform and the approval of the pension reform. “Such reforms will attract new opportunities and investments into the market,” he said.

Retail Commercial Director of Tokio Marine, José Luís da Silva, presented three reflections on the congress: the phenomenon of cooperatives, which requires an understanding of the broker and insurers and the ideal way to combat them, the universe of selling besides the automobile product and strengthening the partnership between professionals and companies. “We can no longer talk about direct selling and the broker will disappear from the market,” said José Luís. Mitsui’s vice president, Hélio Kinoshita, congratulated the organizers of the event and emphasized that the initiative favored companies who started work in the Midwest and Minas Gerais. “We kept very interesting contacts with brokers,” he said.

Participants in a specific panel in Congress, executives stressed that the meeting promoted the union of teachers in the universe of insurance companies and the need to combat vehicle protection associations. “The debates stimulated reflections and various provocations,” said Leonardo Freitas, commercial director at Bradesco Seguros. He expects insurtechs to bring solutions in terms of pricing, marking a presence in an “unoccupied” market, or filled by cooperatives. Rivaldo Leite, Porto Seguro’s executive director of production, understands that the great reflection focused on the activities of vehicle protection associations. “From time to time new threats appear. Some of them we can contain, others we can not. But the horizons of the market are great and there are other prospects for action.”

You may be interested

Seguros Unimed é a nova patrocinadora da equipe Itambé Minas

Publicação - 9 de janeiro de 2026A equipe Itambé Minas vai contar com o patrocínio da Seguros Unimed, braço segurador e financeiro do Sistema Unimed, até o fim da temporada 2025/26. A seguradora, especialista em soluções que…

Gallagher destaca papel da especialização técnica

Publicação - 9 de janeiro de 2026Após quase um mês da sanção da Nova Lei de Seguros (Lei nº 15.040/2024), a Gallagher Seguros ressalta que o sucesso da implementação das novas regras dependerá…

Amil Me Leva 2025 foi uma das vencedoras do Prêmio Caio

Publicação - 9 de janeiro de 2026A viagem de incentivo Amil Me Leva 2025 foi uma das vencedoras do Prêmio Caio, considerado o “Oscar dos Eventos” no Brasil, no mês de dezembro. O…

Mais desta categoria