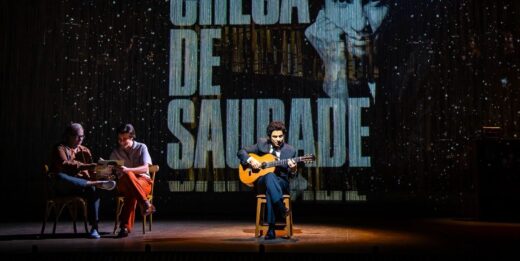

There is a very significant survey by Sebrae when it comes to business succession. In Brazil, about 90% of organizations are family members. But on that spectrum, only 30 reach the second generation. Insurance brokers have already expressed their concern on this issue more than once. The São Paulo Insurance Brokers Club (CCS-SP), then, held a live, called “Business Succession”, broadcasted on the entity’s YouTube channel (photo).

Father and son pairs were the protagonists – Jayme and Bruno Garfinkel(Porto Seguro) and Boris and Fernando Ber(Asteca Corretora), two successful examples of business succession. They shared their experiences and presented important tips for those who want to understand the succession process. The presentation and mediation were in charge of the CCS-SP Mentor, Evaldir Barboza de Paula, and the director Ivone Elise Gonoretske.

Jayme started the live, remembering that his soon initiated to reflect on the theme, because his father died early. “This was a subject that I experienced and I always thought about the company’s longevity. But I also thought about my children’s future”, he said. Boris, for his part, said he started to wake up to the subject when he realized that his fellow brokers did not talk about succession and “did not even think about it”.

When asked about where in the succession process Porto Seguro is, Jayme said he left the Company and passed all the questions that come to him to Bruno. “I see only the reports”, he amended. Boris Ber still does the process in Asteca. “I identified an area within the brokerage firm where Fernando could develop and, therefore, he went to study financial risks”, he revealed. “He attended board meetings only as a listener and, today, he has an active voice”, he added.

In Bruno’s view, the challenge of the succession process is to take off “the hat of a son and heir”, saying that he feels uncomfortable when people try to minimize his achievements. “I never had a facilitated way by the family”, he points out. And he adds: “Our successes are nothing but an obligation and when we make mistakes, it is said ‘poor Jayme failed’, look how incompetent his son is. Are there any advantages? Certainly!. I had the opportunity to study things that many people did not have”.

For his part, Fernando said that there is a lot of pressure in this process. “Successful companies with a solid history, at a given moment, the responsibility for taking business to another level and keeping them alive reflect on us”, he admits. Fernando warns: there is no point in having a successor – whether son or not – who does not know how the company works. “It is necessary to understand the difficulties, how the gears work and the day by day business”.

As advice to his sons in succession, Jayme reminds that when his father was alive, he treated him as Mr. Garfinkel at the company. “I complied what he said, many times upset. In my case with Bruno, he protested a lot to his mother, but he always did the assignments”. Jayme concludes: “He respected the hierarchy”.

“Business cannot die”

Business succession was also one of the themes of a previous live promoted by the Club – “Insurance Distribution – Partnerships and Cooperation”. The virtual debate feature the series “Prata da Casa”outset, congregatering three CCS-SP associates who work in advisory services – Jorge Teixeira Barbosa (Valor-Ação), Nilson Barreto (NBA) and Roberto Benedito de Oliveira (Active), under Mentor Evaldir mediation.

On the occasion, Evaldir narrated his successful experience in terms of succession. Já Oliveira said that advisors usually alert brokers in need of preparing the next generation. “The important thing is not to let the business die”, he asserted. According to the Mentor, in addition to stimulating the sons, it is worth taking advantage of the programs offered by insurance companies, providing training and group dynamics.

According to Barreto, sometimes, brokers who do not reach the targets confront restrictions. Barbosa said that this is an ancient discussion. “Advisory services serve small brokers, because if they were large, they would work directly with insurance companies and other commercial conditions. For this reason, there is no point in demanding from the small what he cannot fulfill”, he said.

In this regard, Oliveira came to disagree on the brokers’ size definition. “Sometimes it is difficult to measure, because an average broker for advice can be small for the insurance company. But, in general, the insurers act diplomatically”, he said. Then, the Mentor expounded the Internet user Regina opinion:” Why pass over the small broker if in the future he can be big? “. Evaldir agreed:” The small developments are for the entire market”.

You may be interested

HDI e Yelum prestam atendimento a MG após fortes chuvas

Publicação - 26 de fevereiro de 2026O Grupo HDI, por meio de suas marcas HDI e Yelum, está atuando de forma intensiva no apoio à população de Minas Gerais impactada pelas fortes chuvas…

Indenizações no Seguro de Crédito no RS crescem mais de 50%

Publicação - 26 de fevereiro de 2026Em um ano marcado por maior pressão econômica sobre as empresas, o Seguro de Crédito ganhou protagonismo no Rio Grande do Sul como instrumento de proteção financeira.…

Grupo A12+ confirma presença estratégica no 6º CONSEGNNE

Publicação - 26 de fevereiro de 2026O Grupo A12+, referência em inovação e escala para o mercado de seguros, confirma sua participação no 6º CONSEGNNE – Congresso dos Corretores de Seguros do Norte…

Mais desta categoria